Abstract: Questrade, part of Questrade, Inc. A Canadian broker founded in 1999 andheadquartered in Toronto. Currently in a well-regulated state by CIRO, it offers popular trading instruments including Stocks, ETFs, options, GICs, etc., 23 customized accounts and 5 trading platforms for Canadian traders. It has served the Canadian market for 24 years and manages more than $30 billion, making it the low-cost option for Canadian digital investors.

Questrade, part of Questrade, Inc. A Canadian broker founded in 1999 andheadquartered in Toronto. Currently in a well-regulated state by CIRO, it offers popular trading instruments including Stocks, ETFs, options, GICs, etc., 23 customized accounts and 5 trading platforms for Canadian traders.

It has served the Canadian market for 24 years and manages more than $30 billion, making it the low-cost option for Canadian digital investors.

Questrade Pros & Cons

✅Cost savings: It can be summed up in four “free” words -No account opening fee, no annual RRSP or TFSA fees, buy ETFs commission free and transfer your account for free.

✅Well-regulated: Regulated by effective institution CIRO to protect your transactions.

✅23 account types: Realistically planned account types that cover something traders care about.

✅5 trading platforms: Support different devices, are suitable for different types of traders, and help you trade.

✅Various types of trading instruments: Covers Stocks, ETFs, options, GICs, IPOs, CFDs, Mutual Funds, Bonds, FX, International Equities, Precious Metals.

❌Minimum deposit $250: For traders who are not well-funded, the threshold is a little higher.

Is Questrade Legit?

Yes, it is. For you to find Questrade's license information, please rest assured:

Questrade is regulated by the Canadian Investment Regulatory Organization (CIRO) and holds a CIRO Market Making (MM) type regulatory license.

WikiFX has been deeply involved in the industry for more than ten years and has the world's largest database of forex brokers, providing real information including but not limited to company qualifications, regulatory status, historical performance, user reviews, risk ratings, etc., all of which have been strictly reviewed.

What can I trade on Questrade?

Stocks, ETFs, options, GICs, these are the popular products of Questrade.

- Stocks: You can trade at prices as low as 1¢/ share.

- ETFs:There is no commission for trading ETFs.

- Options: It offers you the flexibility to buy or sell your investment at a fixed price.

- GICs:The minimum purchase amount of $5,000 to help you diversify your portfolio and reduce risk.

But Questrade offers more than that. There are many more products you can trade:

- IPOs: Types of new offerings/ipos in Canada and other investment products, including Canadian equities, Fixed income, Structured notes, etc.

- CFDs: You can trade CFDS on international stocks, indices, commodities, etc.

- Mutual Funds: Questrade says there are thousands of funds to choose from.

- Bonds: Questrade allows you to trade government bonds, municipal bonds, corporate bonds.

- FX:110 + currency pairs, Questrade says you can enjoy high liquidity and low transaction fees.

- International Equities: allows you to invest in non-US stocks.

- Precious Metals: Questrade allows you to buy and sell physical precious metals such as gold and silver in all your accounts.

Questrade does not offer trading opportunities in cryptocurrencies or energy, “but a blemish doesn't cover it”.

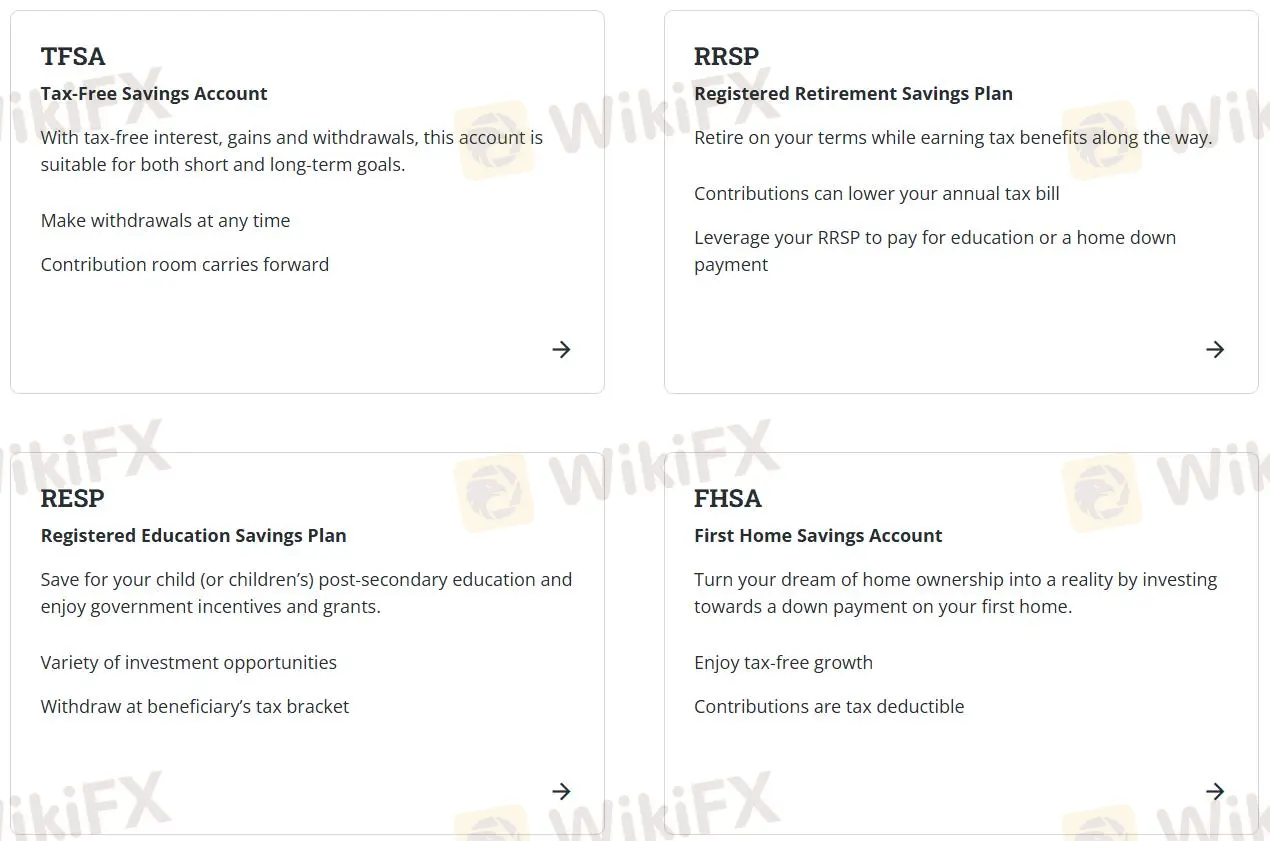

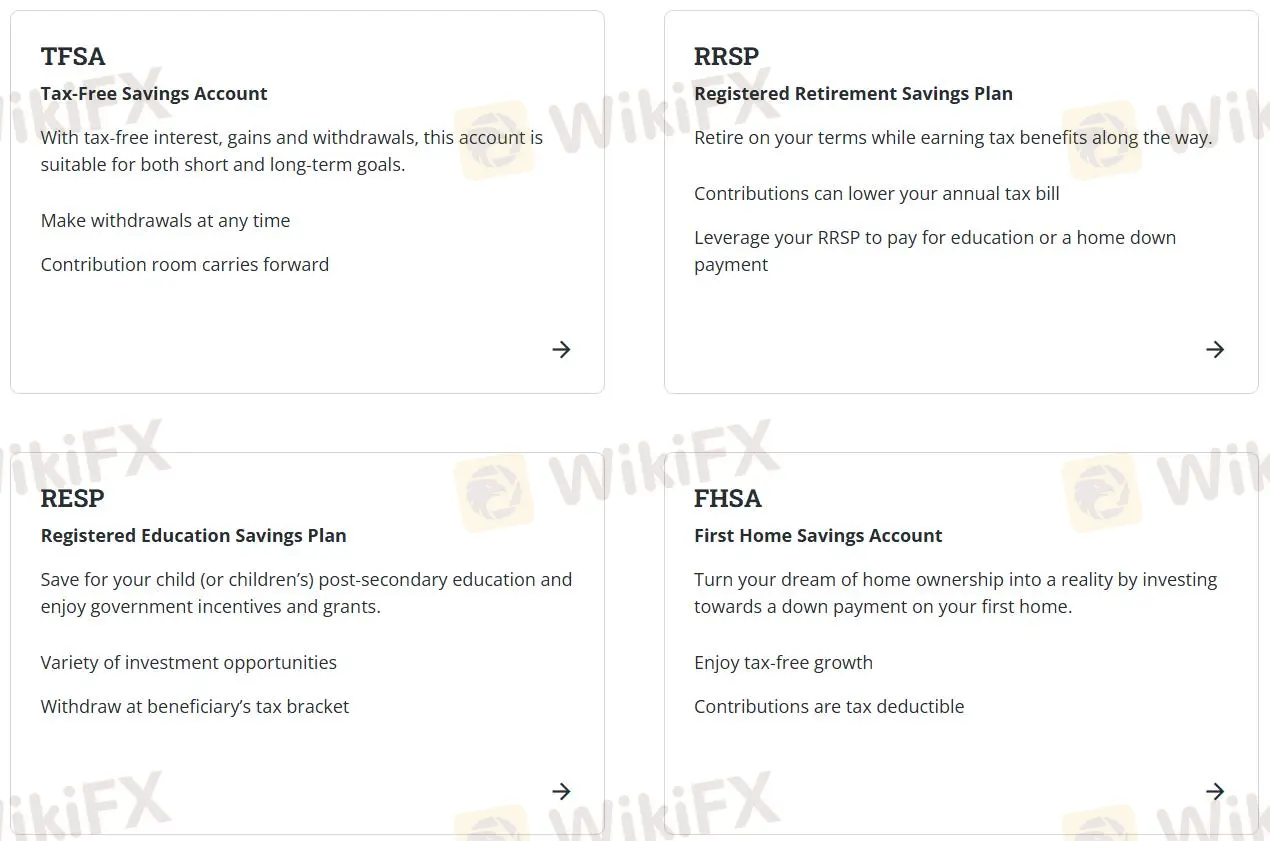

Account Types

Questrade's account type seems to be “set up” for your whole life. It mainly recommends 4 types of accounts for traders -Tax-Free savings Account (TFSA), Registered Retirement Savings Plan (RRSP), Registered Education savings Plan (RESP), First Home savings Account (FHSA).

Questrade's investment accounts are tailored to your goals, helping you save for your children, retirement and more.

Now that we know about account types, let's talk about how to open an account.

It is important to remind you that Questrade is from Canada and primarily caters to Canadian traders. You need to check if Questrade supports account opening in your region.

Opening an account with Questrade is a simple matter. You can browse the following information as a reference:

- Fill out the registration form on Questrade's website to apply for an account. After the broker reviews the verification, the first deposit can be made and trading can begin.

- The registration procedure only requires careful following instructions.

- The following steps are usually taken after the application process has concluded or your identity has been verified:

- Fill out the trading experience questionnaire

- Select an account type and a base currency

- The final step is to deposit funds and start trading

Questrade Trading Fees

Presumably pricing is one of your most important pieces of information. Well, here's what I want to tell you that Queatrade is priced in 3 parts: Self-directed Investing, Questwealth Portfolios and Active Traders Pricing. Details are as follows:

Questrade has detailed fee information for 11 different types of products that can be traded.

Questrade has set up a “calculator” on its website to get quick details on fees. I will reveal the minimum Account balance and maximum Account balance fees for your reference:

In addition, Queatrade allows you to switch to Questwealth for free, reimbursing financial institutions for transfer fees charged to you, up to $150 per account. There is no minimum amount required.

Active Traders Pricing, which is more likely to be a strategy of this broker to stimulate traders to trade more. Before I explain “why”, let me tell you that the Active Traders Pricing offers traders two plans, as shown below:

If you are interested in plans, then I'd like to point out that that's where the “words” come from: unlock more pricing and fee rebate information for active traders, you must choose a live stream package that includes Canadian or US market data, namely Advanced market data packages, as shown below:

Both of these packages, when compared to Real-Time Options, offer traders additional Level 1 and Level 2 data to learn more about U.S. or Canadian exchanges and indices.

In order to attract traders, they also offer the “lure” of partial rebates on top of full rebates. But “the gift of fate has a price tag”, and these benefits are based on certain conditions: the monthly fee is automatically refunded for trading commissions over $399.95 or Canadian dollars. Trade commissions over $48.95 or CAD and receive an automatic rebate of $19.95 or CAD.

Real-Time Options is sufficient for most traders. If you have more money or need to trade larger products or markets, you can choose between these two packages.

Trading Platforms

As mentioned earlier, Questrade does not offer the popular MetaTrader 4 and MetaTrader 5 platforms, and traders who prefer these standard tools may need to consider other brokers.

Questrade offers 5 proprietary platforms:

It is an all-in-one platform that can be easily used by any web browser. Questrade Trading brings your accounts together in one place, so you can buy and sell, research, check balances and transfer funds all in one intuitive platform.

On the platform interface, there is a comprehensive chart feature that shows a comprehensive snapshot of all your investment accounts at a glance. It also enables you to do component lookups, access news and performance statistics on items you are interested in, and get real-time quotes.

QuestMobile, the mobile equivalent of Questrade Trading. For traders, the biggest advantage is that they can invest in one place at any time. This is still very friendly for novice traders.

It gives you access to advanced order types, including bracket orders, multilateral options orders, and more. One highlight is the use of its advanced charting feature to analyze the movement and performance of a stock or ETF, where important information can be visually presented.

As you can see from the interface, this platform is relatively more sophisticated and more suitable for experienced traders.

It allows you to trade 24 hours a day, access global markets with 15+ international exchanges and high leverage. Applying technical analysis and annotations requires you to get started with a few simple clicks on the platform.

In addition, it provides a demo account for traders, who are more alert to risk, and can use Questrade Global's charting and analysis tools to experience and practice.

Deposit and Withdrawal

Deposit Options

Questrade lists 7 ways to deposit money and the specific requirements involved. There are various payment methods, but it is a little unfortunate that the minimum deposit amount is not directly stated, limit CAD and USD trading.

Withdrawal Options

Questrade can withdraw money in two ways. The most popular withdrawal method is EFT, It is completely free, but may take up to 5 business days to process. Wire transfer is faster, but there is a small fee.

Customer Support

Questrade's website is available in English and French. You can get customer support through online chat on the official website. If you want to be contacted by phone, select the correct phone number supported in your area.

Questrade supports email contact, but you need to send an email on the official website. In addition, the Questrade team can be found on social media and offline addresses.

Whether you are a new trader or an experienced trader, Questrade provides tools that can be a useful aid in your investment journey.

- News, Insights & Research

Use it to help you find investment ideas and opportunities when you're confused about investing. Morning Brief delivers daily stock market news from the U.S. and Canadian stock markets to your inbox so you can get the latest investment news and choose the right one for you.

- Investing & Trading Tools

Access real-time market data, order entry types and create custom layouts and workspaces to trade in the way you feel comfortable.

The biggest feature is to help you track markets and investments. Regularly updated investment reports, customized investment lists and tracking, and alert Settings allow you to not miss the opportunity to change your investment.

The Bottom Line

After getting to know and experiencing Questrade, one of the most impressive aspects is its website, which offers a wealth of information—like peeling an onion, revealing layer after layer.

It's important to note that while Questrade provides comprehensive offerings in terms of accounts, trading platforms, and fees, its primary drawback is that it's limited to Canadian traders and the “disappearing” MT4/5 platform.

Each day, WikiFX conducts field surveys on the broker's Office address and environment, verifying whether the office space and team size align with public information. Before making a decision, utilizing the services of WikiFX to evaluate the broker is an advantageous approach.