Produknya

MorePemilihan pialang

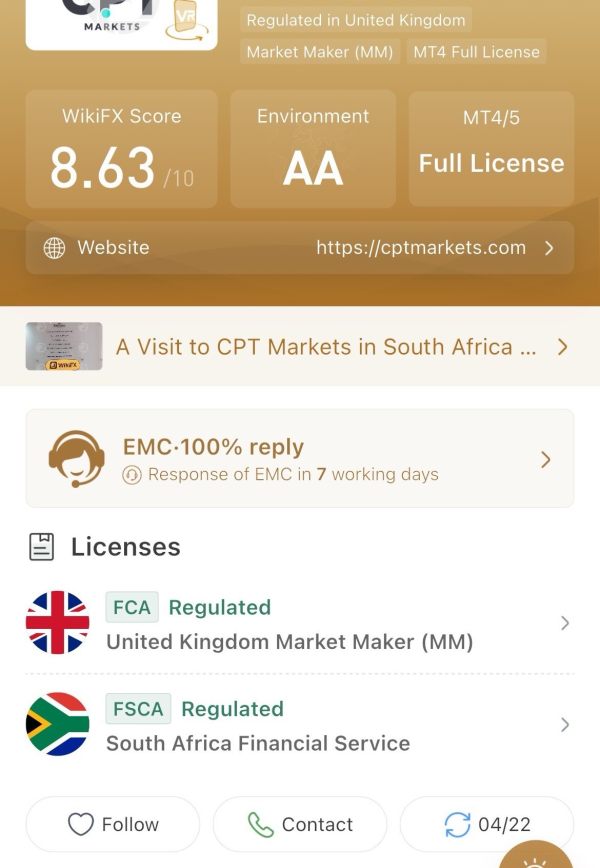

Saring dan sajikan evaluasi komprehensif dari berbagai broker. Anda dapat melihat informasi regulasi, layanan perusahaan, deposit dan penarikan, spread, berita, ulasan pengguna, keluhan, dan lainnya. Filter pencarian kami membantu Anda mempelajari lebih lanjut tentang broker serta informasinya, sehingga memudahkan Anda dalam memilih broker berkualitas tinggi untuk pembukaan akun atau verifikasi informasi.

Broker comparison

Pilih halaman informasi yang komprehensif untuk dua atau lebih broker guna membandingkan regulasi, deposit dan penarikan, spread, ulasan, keluhan, dan detail lainnya. Dengan melakukan penilaian menyeluruh terhadap broker-broker tersebut, Anda dapat menganalisis kelebihan dan kekurangan mereka, sehingga membantu Anda memilih broker berkualitas yang sesuai dengan kebutuhan Anda saat ini

Institusi Populer

Produknya

MorePemilihan pialang

Saring dan sajikan evaluasi komprehensif dari berbagai broker. Anda dapat melihat informasi regulasi, layanan perusahaan, deposit dan penarikan, spread, berita, ulasan pengguna, keluhan, dan lainnya. Filter pencarian kami membantu Anda mempelajari lebih lanjut tentang broker serta informasinya, sehingga memudahkan Anda dalam memilih broker berkualitas tinggi untuk pembukaan akun atau verifikasi informasi.

Broker comparison

Pilih halaman informasi yang komprehensif untuk dua atau lebih broker guna membandingkan regulasi, deposit dan penarikan, spread, ulasan, keluhan, dan detail lainnya. Dengan melakukan penilaian menyeluruh terhadap broker-broker tersebut, Anda dapat menganalisis kelebihan dan kekurangan mereka, sehingga membantu Anda memilih broker berkualitas yang sesuai dengan kebutuhan Anda saat ini

Institusi Populer

Produknya

MorePemilihan pialang

Saring dan sajikan evaluasi komprehensif dari berbagai broker. Anda dapat melihat informasi regulasi, layanan perusahaan, deposit dan penarikan, spread, berita, ulasan pengguna, keluhan, dan lainnya. Filter pencarian kami membantu Anda mempelajari lebih lanjut tentang broker serta informasinya, sehingga memudahkan Anda dalam memilih broker berkualitas tinggi untuk pembukaan akun atau verifikasi informasi.

Broker comparison

Pilih halaman informasi yang komprehensif untuk dua atau lebih broker guna membandingkan regulasi, deposit dan penarikan, spread, ulasan, keluhan, dan detail lainnya. Dengan melakukan penilaian menyeluruh terhadap broker-broker tersebut, Anda dapat menganalisis kelebihan dan kekurangan mereka, sehingga membantu Anda memilih broker berkualitas yang sesuai dengan kebutuhan Anda saat ini

Institusi Populer

Produknya

MorePemilihan pialang

Saring dan sajikan evaluasi komprehensif dari berbagai broker. Anda dapat melihat informasi regulasi, layanan perusahaan, deposit dan penarikan, spread, berita, ulasan pengguna, keluhan, dan lainnya. Filter pencarian kami membantu Anda mempelajari lebih lanjut tentang broker serta informasinya, sehingga memudahkan Anda dalam memilih broker berkualitas tinggi untuk pembukaan akun atau verifikasi informasi.

Broker comparison

Pilih halaman informasi yang komprehensif untuk dua atau lebih broker guna membandingkan regulasi, deposit dan penarikan, spread, ulasan, keluhan, dan detail lainnya. Dengan melakukan penilaian menyeluruh terhadap broker-broker tersebut, Anda dapat menganalisis kelebihan dan kekurangan mereka, sehingga membantu Anda memilih broker berkualitas yang sesuai dengan kebutuhan Anda saat ini